Kentucky VA Loan Guide • Updated for 2026

Most Asked Questions About Kentucky VA Loans (2026 FAQ)

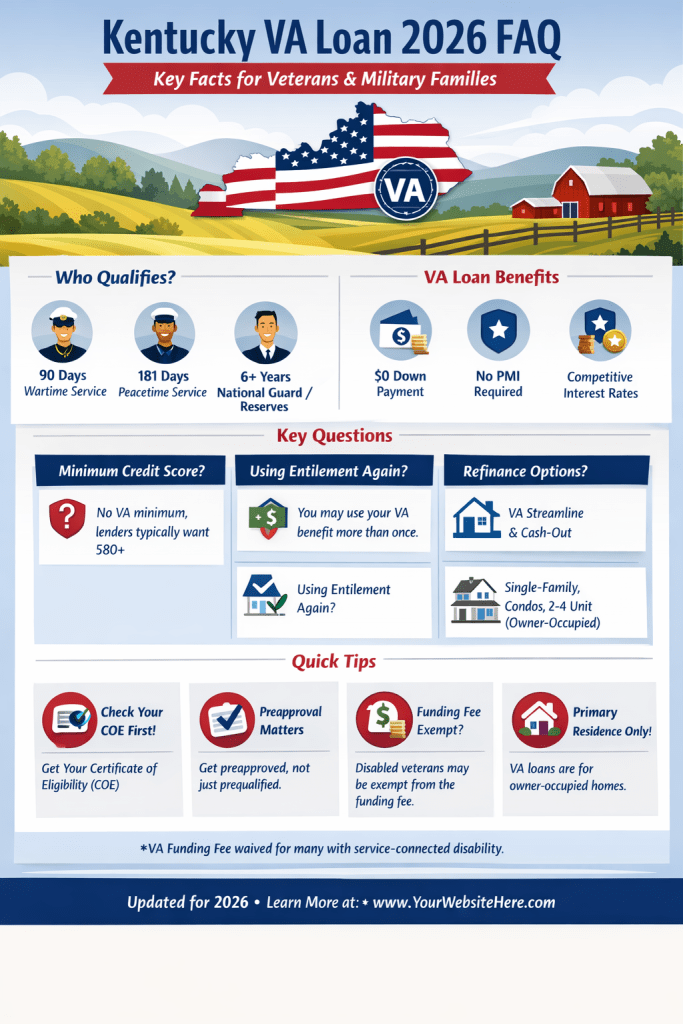

If you’re a veteran, active duty service member, or surviving spouse in Kentucky, the VA loan can be one of the strongest paths to homeownership. This 2026 FAQ answers the questions buyers ask the most—eligibility, credit, income, entitlement, funding fee, rates, assumptions, and refinancing.

Quick Take (tell-it-like-it-is)

- Eligibility means you earned the benefit. Approval means you meet lender underwriting.

- VA doesn’t set a minimum credit score, but lenders often do.

- VA loans are for primary residences—no rentals or vacation homes.

- Funding fee applies unless you’re exempt (often due to service-connected disability).

Table of Contents

- VA Loan Eligibility

- Entitlement & Using Your Benefit More Than Once

- Qualification: Credit, Income, DTI & Residual Income

- Rates, Closing Costs & the VA Funding Fee

- VA Loan Guidelines & Common Rules

- VA Refinance Options

- What Types of Homes You Can Buy

- Next Steps (Prequal → Preapproval)

- Disclosures

VA Loan Eligibility (2026)

What is VA loan entitlement?

VA loan entitlement is the portion of your VA benefit that backs (guarantees) a percentage of your mortgage for an approved lender. The VA does not issue home loans directly—lenders do—while the Department of Veterans Affairs provides the guaranty that makes $0 down and no PMI possible. In 2026, veterans with full entitlement are not subject to county loan limits for a primary residence, but you still must qualify based on income, credit, and the home’s appraised value.

Am I eligible as a surviving spouse?

Many surviving spouses are eligible for VA home loan benefits. Common eligibility paths include:

- Unmarried surviving spouse of a veteran who died on active duty or from a service-connected disability

- Surviving spouses who remarried after age 57 and on/after December 16, 2003 may remain eligible

- Spouse of an active-duty service member who is MIA or POW for 90+ days may be eligible for one-time use

Surviving spouses may also be eligible for VA refinancing options in some circumstances, including VA Streamline (IRRRL).

How do I get my Certificate of Eligibility (COE)?

The COE is the official proof of your eligibility and entitlement. Most lenders can retrieve it electronically in minutes. Veterans can also request the COE through the VA, which may take longer. Bottom line: you can’t close a VA loan without a COE.

Who is eligible for a VA loan?

You may be eligible if any one of the following is true:

- 90 days of active duty during wartime

- 181 days of active duty during peacetime

- 6 years in the National Guard or Reserves

- Eligible surviving spouse

Eligibility vs. prequalification vs. preapproval

Eligibility confirms you earned the VA benefit. Prequalification is an initial estimate of buying power. Preapproval is the stronger, document-backed step that real estate agents and sellers take seriously. If you’re shopping in Kentucky, aim for preapproval—not just a quick prequal—before making offers.

Entitlement & Using Your VA Loan More Than Once

How does entitlement work in 2026?

Entitlement generally has two layers (basic and bonus) that together determine the VA guaranty. If you’ve used your VA loan before, you may still have remaining entitlement available. Prior use does not automatically block another VA purchase—structure matters.

How do I restore my VA entitlement?

Full entitlement is commonly restored when you sell the home and the VA loan is paid off. You then request restoration through the VA (typically with VA Form 26-1880), along with documentation showing payoff. In limited cases, a one-time restoration may apply.

What is “second-tier” entitlement?

Second-tier entitlement can help veterans buy again after prior VA loan usage or even a foreclosure history. Depending on remaining entitlement and purchase price, a down payment may be needed. This is where a lender who understands VA structure makes a difference.

Can I use a VA loan for a second home or rental property?

No. VA loans are designed for owner-occupied primary residences. You must intend to occupy the home as your primary residence within a reasonable time after closing.

Qualification: Credit, Income, DTI & Residual Income

Who sets VA loan guidelines: the VA or my lender?

The VA sets minimum standards. Lenders add overlays. VA does not publish a minimum credit score, but most lenders use a benchmark. You must satisfy both VA requirements and the lender’s underwriting rules to get approved.

If I have bad credit, can I still get a VA loan?

Possibly. Here’s the straight answer: poor credit can be worked around in some cases, but it depends on the overall risk profile—income stability, residual income, payment history, and how recent the credit events are. “Quick fixes” usually fail; documented improvement and a clean recent history work.

Can someone else sign on the loan with me?

VA co-borrowers are restricted. In most cases, the co-borrower must be your spouse or another eligible veteran. Parents, friends, or significant others who are not eligible veterans typically cannot co-borrow on a VA loan.

What income can I use to qualify?

Lenders verify that you have stable, reliable income and enough residual income after housing and debts. Common income sources include:

- Military base pay and allowances (including BAH, when stable and likely to continue)

- Non-military employment

- Retirement and disability income

- Self-employment (with additional documentation)

- Commissions, overtime, bonus income (typically needs a 2-year history)

- Spouse’s income, alimony/child support (when documentable and expected to continue)

How long after bankruptcy or foreclosure can I qualify?

Bankruptcy and foreclosure do not automatically disqualify you, but timing matters. Many lenders look for about 2 years after Chapter 7 discharge or foreclosure. Chapter 13 may be possible after 12 months of on-time plan payments with trustee approval, depending on the lender. Overlays apply—this is not one-size-fits-all.

Do I need tax returns to apply?

Not always. Many borrowers can qualify without providing tax returns, because lenders can use IRS transcripts and W-2/paystub documentation. Self-employed or commission-heavy income usually requires tax returns and additional paperwork.

Rates, Closing Costs & the VA Funding Fee (2026)

What fees should I expect to pay?

VA limits certain charges to protect veterans from excessive lender fees. Typical costs include title/settlement fees, appraisal, credit report, and the VA funding fee (unless you’re exempt). Sellers can contribute up to a set amount in concessions, which may help reduce your cash to close.

What is the VA funding fee?

The VA funding fee is a one-time fee that helps keep the VA loan program running and replaces monthly mortgage insurance. The fee varies based on loan type (purchase/refi), down payment (if any), and whether it’s first-time or subsequent use. Many veterans with service-connected disability ratings are exempt from the funding fee.

Funding fee (typical structure)

Funding fee percentages can change. For the most current official funding fee chart, reference the VA’s site: VA funding fee & closing costs (official VA).

If you want, we can estimate your funding fee based on your COE status and the exact structure of the loan.

How are VA loan rates determined?

Rates are driven by broader markets (especially bonds) and by your risk profile (credit, down payment, occupancy, property type). Rate pricing can change daily. If you’re shopping seriously, timing your lock strategy matters.

Does my credit score affect my VA loan rate?

Yes. Even with VA’s flexibility, stronger credit typically improves pricing and reduces lender conditions. If your scores are borderline, improving them before you lock can materially reduce the total cost over time.

Does the VA loan offer adjustable rates?

Some lenders offer VA ARMs (adjustable-rate mortgages). They can make sense for short-term ownership plans (common with relocations), but they are not the default best option for most buyers.

VA Loan Guidelines & Common Rules

Can I borrow more than the home’s value?

On purchases, VA financing is tied to the appraised value and allowable costs. Cash-back is limited on purchases. For refinances, VA Cash-Out can allow high loan-to-value in certain scenarios, subject to lender guidelines.

Can I have more than one VA loan at a time?

Sometimes, yes—typically tied to legitimate occupancy needs (relocation, deployments, job moves). Most veterans have one VA loan at a time, but multiple VA loans can be possible depending on remaining entitlement and circumstances.

What is the maximum VA home loan?

VA does not set a maximum loan amount for borrowers with full entitlement. Your maximum is determined by income qualification, residual income, credit, and the property’s appraised value.

Are VA loans assumable?

Yes. VA loans are assumable, which means a qualified buyer may be able to take over the existing rate and terms. Assumability can be a major resale advantage in higher-rate environments, but the buyer must qualify and the servicer must approve the assumption.

Can I pay off a VA loan early?

Yes. VA loans do not have a prepayment penalty. You can pay extra principal or pay off the loan early without lender penalties.

When is a VA loan NOT the best option?

VA is the strongest fit for most eligible buyers—especially those using $0 down. That said, if you have a large down payment and exceptional credit, conventional financing can sometimes compete on pricing. The best move is a side-by-side comparison, not an assumption.

VA Refinancing (2026)

Can the VA loan help lower my monthly bills?

VA has two primary refinance options:

- VA IRRRL (Streamline): Designed to reduce rate/payment on an existing VA loan with lighter documentation.

- VA Cash-Out Refinance: Refinance and potentially access equity; can also refinance a non-VA loan into VA if eligible.

Streamlines can sometimes be completed without an appraisal, depending on lender policy.

Can I refinance into a VA loan if I don’t currently have one?

Yes. Eligible veterans can refinance a conventional or FHA mortgage into a VA loan using the VA Cash-Out refinance program (even if you’re not taking cash out), subject to underwriting and lender guidelines.

What Types of Homes Can I Buy With a VA Loan?

You can typically use a VA loan in Kentucky to:

- Buy a primary residence (single-family home)

- Buy a VA-approved condo

- Buy up to a 4-unit property (one unit must be owner-occupied)

- Build a home (with additional requirements)

- Buy and improve a home in certain scenarios

You cannot use a VA loan to buy a vacation home or an investment property you won’t occupy as your primary residence.

Helpful VA resource: VA home loans overview (official VA)

Next Steps: Prequal → Preapproval

Fast, clean plan to get approved

- Confirm eligibility by pulling your COE (we can usually do this quickly).

- Review income, debts, and residual income to set a realistic price range.

- Run a preapproval (not just a prequal) before you start writing offers.

- Discuss funding fee exemption and closing cost strategies (seller concessions, credits, etc.).

Related Kentucky VA Loan Resources

- Kentucky VA Loans (Start Here)

- VA Assumable Mortgages in Kentucky (How it really works)

- VA vs FHA vs Conventional (Kentucky comparison)

- Zero Down Options in Kentucky (VA + USDA)

If you’re not sure whether VA is the best fit, we can run a side-by-side comparison and make the decision based on numbers—not guesswork.

You must be logged in to post a comment.