We recognize that our veterans provide an invaluable service. As such, we fully support home loan programs guaranteed by the U.S. Department of Veterans Affairs that are specifically designed to support veterans and their families. Although there are many perks that come with a VA versus conventional loan, a conventional loan offers some benefits that are not available through a VA loan. Let’s compare both of these loans to determine which type is best for you.

What Is a VA Loan?

A VA loan is a great benefit for those who have contributed to their country by serving in a military capacity. It is intended to give veterans access to home loans with advantageous terms. The federal government guarantees a portion of the loan, enabling veterans to qualify for more favorable terms when working with private lenders. The VA loan program was designed to offer long-term financing to eligible American veterans or their surviving spouses (provided they do not remarry). In addition to helping veterans buy, build, repair, retain or adapt a home for their own personal occupancy, it was also created to help veterans purchase properties with no down payment.

What Are the Pros and Cons of a VA Loan?

There are a myriad of reasons why a veteran would want to choose a VA Loan. A VA loan is federally backed. It also offers lower interest rates and fees than are usually associated with home lending costs. The only cost required by VA loans is a funding fee of one-half of one percent of the total loan amount. And that may be paid in cash or rolled into the loan amount. However, there are some factors you will want to take into consideration when deciding if a VA Loan fits your home buying needs.

- No Private Mortgage Insurance (PMI) or Down Payment Necessary. Eliminating these costs can significantly reduce total housing expenses. Typically, a lender requires a 20% down payment. Borrowers who are unable to put down 20% are considered riskier and as a result must pay a PMI, which is typically 0.58% to 1.86% of the original loan amount per year on a conventional home loan. Because VA loans are federally backed, lenders do not have to worry about the house going into foreclosure and are able to offer a mortgage plan that does not require a PMI without a down payment.

- Interest Rate Reduction Refinance Loan (IRRRL): IRRRL loans are typically used to reduce the borrower’s interest rate or to convert an adjustable rate mortgage (ARM) to a fixed rate mortgage. Veterans may seek an IRRRL only if they have already used their eligibility for a VA loan on the same property they intend to refinance. However, your lender can use the VA’s email confirmation procedure for interest rate reduction refinance in lieu of a certificate of eligibility. Additionally, an IRRRL can reduce the term of your loan from 30 years to 15 years. An IRRRL offers great potential refinancing benefits for vets, but be sure to check the facts to fully understand IRRRL stipulations and avoid an increase in other expenses.

- Native American Direct Loan (NADL) Program: This program was designed to help Native American veterans or spouses of Native American veterans buy, build, or improve a home on federal trust land. This loan also qualifies veteran home buyers for the benefits listed above, in addition to limited closing costs and a low-interest, 30-year, fixed mortgage. Plus, this is a reusable benefit, which means you can get more than one NADL to buy, build or improve another residence in the future.

- Adapted Housing Grants. To qualify for an adapted housing grant, veterans must own or will own the home they are looking to buy, and have a qualifying service-connected disability. This loan is a great option for veterans who are seeking to make home modifications to accommodate a disability. Currently, if you qualify for a grant, you can get up to a maximum of $100,896.

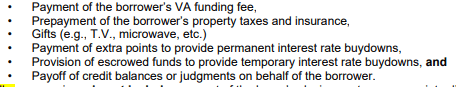

- Funding Fee and Closing Fees. A VA loan funding fee may vary depending on whether you put a down payment on a house. Depending on if you are a first-time VA loan borrower or making a subsequent loan purchase, a funding fee can range from roughly 1.5% on a down payment of 10% or more to 3.5% on downpayment of 5% or less. Closing fees on a house can range from 2–5%. These are definitely costs you will want to consider when determining how much home you can afford.

- Property Eligibility. A VA loan may not be applied to purchasing a farm, property in a foreign country, land or an investment property/second home.

What Is a Conventional Loan and How Does It Compare to a VA Loan?

Conventional mortgage loans are some of the most commonly used housing loans. However, they are not guaranteed by the federal government, so borrowers who are not putting 20% on a down payment will likely incur the costs of a PMI. Unlike government-backed loans, conventional loans are not limited by geographic constraints. They can offer more flexibility than a government-insured loan but may be harder to qualify for and require a higher credit score (at least 620).

For veterans, the main advantage of this loan compared to a VA loan is that it provides options that may fit a wider range of home-buying needs. Here are some benefits of conventional loans:

- Usable for purchases, rate and term refinances and cash-out refinances

- Allow cash out up to 80% of your home’s value

- Debt to income ratios allowable up to 50%

- Usable for primary, secondary or investment properties

- Applicable for condos, single family homes and up to 1–4 unit properties

- First-time home buyer programs with as little as 3% down payments

- Options both with and without escrows or impounds

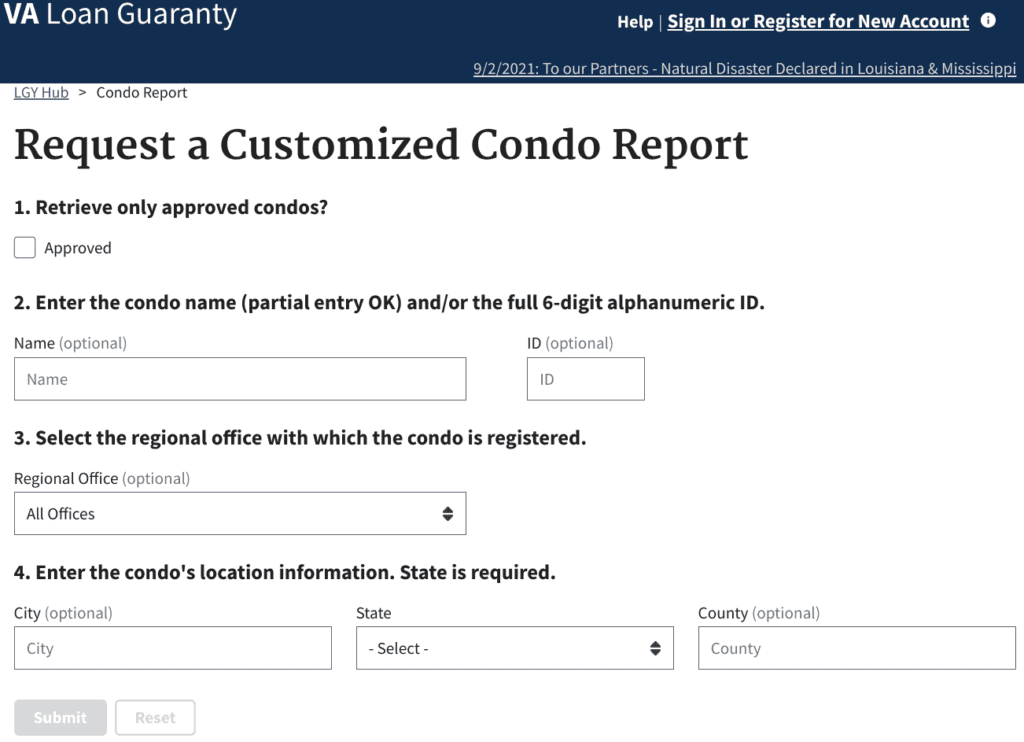

Request a Customized VA Approved Condo Report for Kentucky VA Mortgage Loans. See link below

👇 click link below for list

You must be logged in to post a comment.