Kentucky VA Sales Concessions – How Well Do You Understand This Guideline?

Knowing these tips can help you save a loan!

VA limits Sales Concessions to 4%, but there is more to it than that!

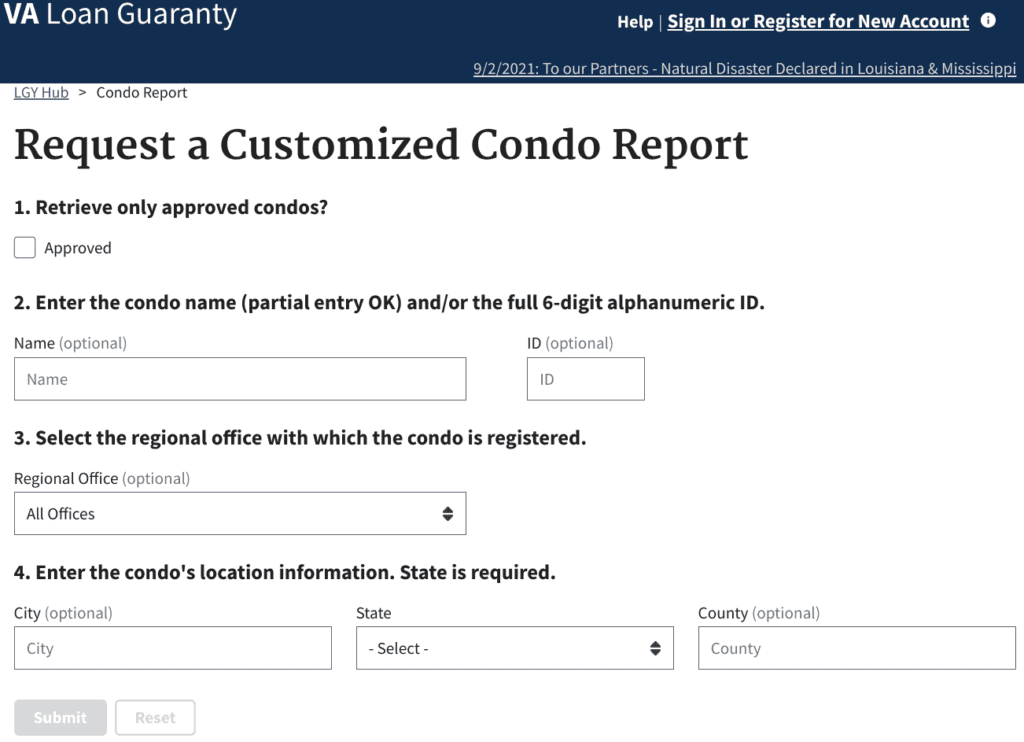

What is a Sales Concession that is applied to the 4% limit?

• Buyer’s funding fee

• Prepaid taxes and insurance

• Gifts such as a television or microwave

• Permanent interest rate buy-down points

• Temporary buy-down funds

• Payoff of Credit Balances or Judgments [Yes, you read that correctly]!

HOWEVER……….

Not included in this limit are the following:

•Amounts paid on behalf of the Veteran by the lender or real estate agent.

•Or amounts paid by the seller towards the closing costs.

These amounts can be paid in addition to the Seller Concessions.

Example:

$200,000 loan amount x 4% = $8000 maximum seller concession.

The seller pays $4000 in closing costs [NOT included as part of the seller concession].

The lender pays $1500 in prepaid items [NOT included as part of the seller concession].

The Seller pays off a judgment for the borrower of $5500 [YES, this IS included as part of the seller concession].

The Agent pays $400 for the home inspection [NOT included as part of the seller concession].

So, the Veteran received $11,400 from a combination of the seller, lender, and Agent.

The seller contributed $9500, but only $5500 is considered part of the 4% seller concession limit. The other $4000 is closing costs, which are not included in the seller concession limit.

Therefore, the total seller concession was $5500, which is less than the maximum seller concession of $8000.

The key to VA sales concessions is understanding what IS and IS NOT included in the sales concession limit. Mastering this guideline will help you save a lot of loans!

You must be logged in to post a comment.