The VA allows you to purchase jumbo loans, but the down payment depends on your entitlement:

- Full entitlement – 100% LTV (loan-to-value) maximum

- Partial entitlement – Maximum loan must be calculated using 25% guarantee of 1 unit county loan limit. Max LTV is lesser of max allowed or LTV required to meet 25% guaranty

Do VA loans have PMI?

Myth #3: VA loans require private mortgage insurance (PMI).

Fact: Private mortgage insurance is not required for VA loans. PMI typically adds 0.2%-0.9% of expenses to your monthly mortgage payments when you put less than 20% down. That’s a big additional expense you don’t have to worry about when you get a VA loan. Remember, VA loans do come with a funding fee.

Can you refinance a VA loan?

Myth #4: You can’t refinance a Kentucky VA loan.

Fact: Thanks to VA streamline and cash-out loan programs, VA loans are actually easier to refinance than conventional mortgages. The streamline version lowers the mortgage rate of an already existing VA loan, usually for less than the current principal and interest. This means it doesn’t require a credit check or appraisal. The cash-out option involves a credit check and appraisal, since the home’s value represents the maximum loan amount and the new loan will be larger than the existing loan.

How many VA loans can you have?

Myth #5: You can only have one Kentucky VA loan.

Fact: There is no limit to the number of VA loans you can have. While it is possible to have multiple VA loans at once, this depends on VA loan entitlement. VA loan entitlement refers to the amount that the VA will pay your lender if you default on your loan. There is a limit on your VA entitlement. It can be split across multiple loans but the limit remains the same. For full entitlement, the VA covers:

- Up to $36,000 for loans < $144,000

- Up to 25% for loans > $144,000

If, however, you’ve used a portion of your entitlement in one loan that you’re still actively paying off (or defaulted on), the amount of entitlement you have on any new loan is reduced. This means that you may need to put money down yourself instead of having the usual benefit of a zero down payment for VA loans. To learn about VA loan limits and entitlement, visit us here.

How many times can you use a VA loan?

Myth #6: You can only use a Kentucky VA loan once.

Fact: There is no limit on the number of times you can use the VA loan benefit. You can use the benefit an unlimited number of times throughout your life, as long as you still qualify. To qualify, you need to meet certain requirements, which you’ll already be aware of if you’ve taken out a VA loan in the past. For those who haven’t taken out a VA loan prior, you can learn how to qualify here.

Are VA loans assumable?

Myth #7: Kentucky VA loans are not assumable.

Fact: Federally insured and guaranteed loans are usually assumable. This includes VA loans. What does it mean if a loan is assumable? An assumable mortgage is when the lender allows you, the buyer, to take over the current mortgage that the seller has. This can save a lot of money if the interest rates are lower on the existing mortgage than they would be to take out a new mortgage. Assumable mortgages allow buyers, who otherwise wouldn’t qualify for a VA loan, to take over a VA mortgage. This means that you would get most, if not all, of the benefits that come with VA loan eligibility. In order to assume a VA mortgage, you will need to meet certain requirements, such as:

- acceptable credit history and credit score

- debt-to-income ratio to meet guidelines

- No Bankruptcies or foreclosures in last 2 years ( Chapter 7) –Chapter 13 is possible within one year in the plan.

- acceptable work history for last two years

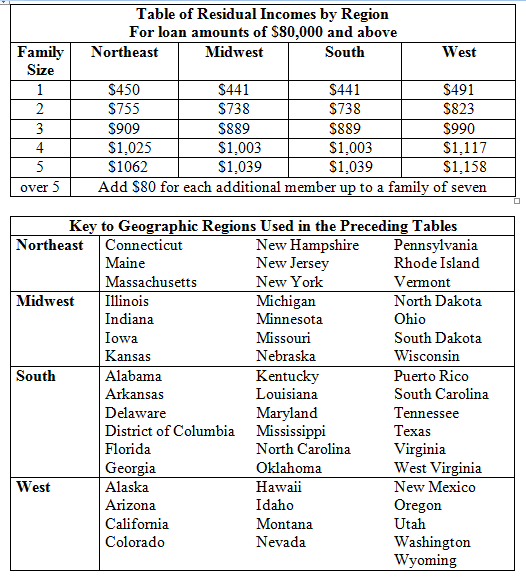

- residual income requirements

- property passing VA standards

You will also be required to pay the VA funding fee that comes with VA loans. This equates to 0.5% of the total loan amount. This may be waived if you’re an eligible military borrower who qualifies for an exemption. Other fees may be required as well.

For sellers, if a non-military borrower assumes your mortgage, your VA entitlement won’t be restored until the loan is paid in full. You will want to request that the lender releases you from liability on the loan to avoid dips in your credit reports if the buyer defaults or makes a late payment.

Can you buy land with a VA loan?

Myth #8: You can’t buy land with a Kentucky VA loan.

Fact: The VA doesn’t authorize buyers to singularly purchase land with a VA loan. However, you can purchase land and build a home on it. This is partially because VA loans are granted with a required occupancy period — you must use the property as your primary residence for at least one year. If there is already a home on the land, this is acceptable. Another acceptable scenario is if you plan to immediately build a home on the land after purchase. This may require a purchase/construction loan.

You can also purchase land with a conventional loan or certain other types of loans. Then you can build a home on the land using a VA construction loan. Upon completion, military borrowers can refinance VA construction loans into permanent VA loans. Builders must be VA-approved.

Finally, you can purchase land and build a property using a non-VA purchase/construction loan. Then you can refinance the loan upon completion of the build into a permanent VA loan (as long as the property meets the VA’s requirements).

Can you use a VA loan to build a house?

Myth #9: You can’t build a house with a Kentucky VA loan.

Fact: VA construction loans do exist, as mentioned above, and under the right circumstances, they can be refinanced into permanent VA loans. Ask your lender about VA purchase/construction loan options.

Can you use a VA loan for home improvement?

Myth #10: Kentucky VA loans only apply to the home purchase itself.

Fact: The VA allows for increases to purchase loans for the purpose of making renovations. The VA’s Energy Efficiency Mortgage program, for instance, lets borrowers add up to $6,000 to their home loan amount to install solar heating, insulation and storm windows, among other features.

In conclusion

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee does not guarantee the quality, accuracy, completeness or timelines of the information in this publication. While efforts are made to verify the information provided, the information should not be assumed to be error free.

You must be logged in to post a comment.