I have successfully originated over 200 VA Home loans in Kentucky. Put my experience to work for you. Call or text me today at 502-905-3708 or email me at Kentuckyloan@gmail.com-This website is not affiliated with the VA or any other government agency. NMLS #57916 Equal Housing Lender. Same Day Approvals, Fast Closings, and a Local Veteran offering VA Home Loans in Kentucky. Free Credit Report and Pre-Approvals NMLS# 57916 Joel Lobb Loan Originator, Company NMLS ID 1738461 . Equal Housing Lender

KENTUCKY VA MORTGAGE LOANS

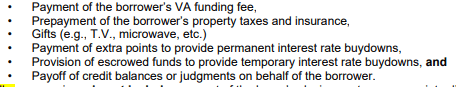

The max seller paid closings costs on a Kentucky VA loans is 4% and with the concessions that can include payoffs of credit balances:

👇

The Department of Veterans Affairs defines a Seller Concession as “…anything of value added to the transaction by the builder or seller for which the buyer pays nothing additional and which the seller is not customarily expected or required to pay or provide.“

The seller’s paying of the buyer’s closing costs is not considered a Seller Concession. A Seller Concession is considered anything paid to the buyer outside of the normal closing costs that is offered to make the sale more attractive to a buyer. These concessions often come in the form of the seller paying such pre-paid items as the Homeowners Insurance premium or the amount needed for property tax escrows.

Another common concession is the seller agreeing to pay the VA Funding Fee on behalf of the veteran or paying the lender discount points to buy down the interest rate on the Veteran’s new VA mortgage. VA Funding Fees are typically financed by the Veteran, so when the seller agrees to pay this cost, this fee does not need to be financed, resulting in lower loan amount and lower payment for the Veteran. By paying discount points to buy down the Veteran’s interest rate, the result can be savings in the thousands over the life of the loan.

These Seller Concessions can even include such items as appliances, TVs, furniture, lawn mowers, etc. If such items are used they need to be listed with a reasonable value assigned to each.

One of the more interesting Seller Concessions allows for the seller to payoff a borrower’s liability, such as a collection, a judgement or a credit balance. Sometimes there is a particular account on a credit report that is preventing a potential home buyer from qualifying for a mortgage. Paying off this account can be offered as a Seller Concession and make the difference between the buyer qualifying and not qualifying for a VA mortgage.

Seller Concessions often include the following…

Is there a limit to the amount of Concessions a Seller can offer?

The Department of Veteran Affairs has capped the amount of Seller Concessions to 4% of the sales price.

Why is their a 4% cap on Seller’s Concessions?

The intent with the cap is to offer protection to the Veteran against overly aggressive Seller Concessions which may tempt Veterans into attempting the purchase a home that may really stretch their budget beyond true affordability.

Wait a minute… you mentioned some items like appliances, TV and furniture can be offered as Seller Concessions, how do we know how much these are worth to make sure their value is within this 4% cap?

For sellers to properly offer such concessions they must provide the buyer and lender with an itemized list of the concessions to be offered. The list needs to make sense and be reasonable. Claiming a 46″ LCD TV is worth $5000 would certainly raise an eyebrow. The list is subject to approval by the VA so make sure these types of concessions are reasonable and fall within the 4% cap.

So just to confirm……If a seller pays any of the buyer’s closing costs it is not considered a Seller’s Concession?

That is correct. The seller can pay all of the buyer’s closing costs without limit and these closing costs are not included in the Sellers Concession 4% cap. If there are closing costs that are considered excessive or are not typical for the area, they can be then included in as a Seller Concession. Since the VA also allows the seller to pay these costs without limit, the result is that the Veteran can often come to the closing table with no money needed.

Thank you,

|

Did You Know?

No Down Payment Requirement on Kentucky VA Jumbo Loans!

|

|

|

A Kentucky VA loan is issued by a private lender in Kentucky and insured by the Department of Veterans Affairs or VA . for qualified U.S. veterans, active-duty military personnel and certain surviving spouses.

You are likely to be entitled to apply for a Kentucky VA mortgage if:

You are active-duty military.

You were separated from military service in a situation “other than dishonorable discharge.”

As a veteran or active military, you meet specific length-of-service requirements.

You are a reservist or a member of the National Guard.

You are a qualified surviving spouse of a deceased veteran.

In addition, there are these requirements:

The home must be your primary residence.

You must have a valid certificate of eligibility from the VA.

Although the VA has no minimum credit score requirement, most lenders do.

A Kentucky VA loan begins with one important distinction: relaxed credit-qualifying standards in regards to credit scores, past bankruptcies and foreclosures

VA has no minimum credit score requirement, lenders often require scores of at least 580 A few lenders will approve loans with credit scores as low as 500 in some cases .2 year removed from bankruptcy and foreclosure is required too with a clear Cavirs number.

THE MAJOR BENEFITS of a Kentucky VA mortgage are as follows:

$0 down payment unless the purchase price is more than the appraised value of the property or it’s higher than the local VA loan limit.

Mortgage rates are typically lower than rates on conventional loans.

No mortgage insurance is required monthly, just upfront funding fees.

You can reuse your VA loan benefit.

You don’t have to be a first-time home buyer.

VA-backed loans can be assumable — this means they can be taken over by someone you sell the house to, even if that person isn’t a service member.

A bankruptcy discharged more than two years ago — and in some cases, within one to two years — will not preclude you from getting a VA loan.

Home purchase in Kentucky: A Kentucky VA loan can be used to buy an existing home or a condominium in a VA-approved development, or to build a home.

Cash-out refinance in Kentucky: A VA cash-out refi replaces your mortgage with a new loan, while tapping some of your home’s value for things like paying off debt or making home improvements. It also can be used to replace a non-VA loan with a VA loan.

Interest rate reduction refinance loan or rate and term: A VA IRRRL (which is pronounced “Earl”) is also called a streamline refinance loan. You can replace an existing VA loan with a mortgage offering a lower interest rate, or move from an adjustable-rate loan to one with a fixed interest rate. Usually no appraisal or income documentation is needed for most IRRRL Refinances saving you a lot of money and qualifying headaches on a refinance

Although mortgage insurance isn’t charged on Kentucky VA loans, a “funding fee” serves the same purpose: to help lenders defray the expenses of foreclosing on borrowers who default. The fee ranges from 1.25% to 3.3% of the loan balance, depending on your down payment, branch of the military and whether or not it’s your first time getting a VA loan.

The VA funding fee can be rolled into your total loan package, but that will likely raise your interest rate and will absolutely raise your monthly payment.

Though a down payment is not generally required, putting 5% or more down will reduce your VA funding fee. And a down payment will lower your monthly payment, too.

Childcare Expenses

Did you know that VA considers childcare expenses a debt?

VA has given guidance that Borrowers with children age 12 and under must complete and sign a “Child Care Letter”. The lender must obtain the letter from the veteran documenting the childcare expense or detailing why no expense is incurred. Ensure that the current daycare provisions will remain logical based on the location of the new home. If applicable, the name and address of the childcare provider, should be obtained. This expense should be listed under section D, line 29, “Job Related Expense (e.g., child care)” on the VA Loan Analysis.

A “VA Child Care Expense Certification” form can be found on the Fairway website under “Forms & Documents” or by clicking here: VA Child Care Expense Certification

Kentucky VA Loans only have a two year mandatory waiting period after foreclosure, deed in lieu of foreclosure, or short sale for a Veteran to qualify for a Kentucky VA Loan.

A list of items needed for underwriting is provided to the buyer based on the buyer’s scenario. Based on the borrower’s scenario, the process is explained which includes the items discussed below such as the VA certificate of eligibility (COE), DD-214, income verification, and more.

The first step in getting a VA direct or VA-backed home loan is to apply for a Certificate of Eligibility (COE). This confirms for your lender that you qualify for the VA home loan benefit. Find out how to apply for a COE. Then, choose your loan type and learn about the rest of the loan application process.

Gather the information you’ll need to apply for your COE. Click on the description below that matches you best to find out what you’ll need:

You can apply online right now.

In some cases, you can get your COE through your lender using our Web LGY system. Ask your lender about this option.

To apply by mail, fill out a Request for a Certificate of Eligibility (VA Form 26-1880) and mail it to the address listed on the form. Please keep in mind that this may take longer than applying online or through our Web LGY system.

Download VA Form 26-1880.

Applying for your COE is only one part of the process for getting a VA direct or VA-backed home loan. Your next steps will depend on the type of loan you’re looking to get—and on your lender (for most loans, the lender will be a private bank or mortgage company; for the Native American Direct Loan, we’ll be your lender).

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

— Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.

You must be logged in to post a comment.