The max seller paid closings costs on a Kentucky VA loans is 4% and with the concessions that can include payoffs of credit balances:

👇

The Department of Veterans Affairs defines a Seller Concession as “…anything of value added to the transaction by the builder or seller for which the buyer pays nothing additional and which the seller is not customarily expected or required to pay or provide.“

The seller’s paying of the buyer’s closing costs is not considered a Seller Concession. A Seller Concession is considered anything paid to the buyer outside of the normal closing costs that is offered to make the sale more attractive to a buyer. These concessions often come in the form of the seller paying such pre-paid items as the Homeowners Insurance premium or the amount needed for property tax escrows.

Another common concession is the seller agreeing to pay the VA Funding Fee on behalf of the veteran or paying the lender discount points to buy down the interest rate on the Veteran’s new VA mortgage. VA Funding Fees are typically financed by the Veteran, so when the seller agrees to pay this cost, this fee does not need to be financed, resulting in lower loan amount and lower payment for the Veteran. By paying discount points to buy down the Veteran’s interest rate, the result can be savings in the thousands over the life of the loan.

These Seller Concessions can even include such items as appliances, TVs, furniture, lawn mowers, etc. If such items are used they need to be listed with a reasonable value assigned to each.

One of the more interesting Seller Concessions allows for the seller to payoff a borrower’s liability, such as a collection, a judgement or a credit balance. Sometimes there is a particular account on a credit report that is preventing a potential home buyer from qualifying for a mortgage. Paying off this account can be offered as a Seller Concession and make the difference between the buyer qualifying and not qualifying for a VA mortgage.

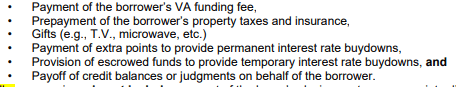

Seller Concessions often include the following…

- paying the pre-paid items such as insurance premiums and tax escrows

- paying the VA Funding Fee

- offering such gifts as TVs, appliances, furniture and other houshold items which are not typically included

- paying off a borrower liabilty such as a collection, judgement or credit balance

Is there a limit to the amount of Concessions a Seller can offer?

The Department of Veteran Affairs has capped the amount of Seller Concessions to 4% of the sales price.

Why is their a 4% cap on Seller’s Concessions?

The intent with the cap is to offer protection to the Veteran against overly aggressive Seller Concessions which may tempt Veterans into attempting the purchase a home that may really stretch their budget beyond true affordability.

Wait a minute… you mentioned some items like appliances, TV and furniture can be offered as Seller Concessions, how do we know how much these are worth to make sure their value is within this 4% cap?

For sellers to properly offer such concessions they must provide the buyer and lender with an itemized list of the concessions to be offered. The list needs to make sense and be reasonable. Claiming a 46″ LCD TV is worth $5000 would certainly raise an eyebrow. The list is subject to approval by the VA so make sure these types of concessions are reasonable and fall within the 4% cap.

So just to confirm……If a seller pays any of the buyer’s closing costs it is not considered a Seller’s Concession?

That is correct. The seller can pay all of the buyer’s closing costs without limit and these closing costs are not included in the Sellers Concession 4% cap. If there are closing costs that are considered excessive or are not typical for the area, they can be then included in as a Seller Concession. Since the VA also allows the seller to pay these costs without limit, the result is that the Veteran can often come to the closing table with no money needed.

Thank you,

Reblogged this on Kentucky First-Time Homebuyer Loan Programs for FHA, VA, KHC and USDA Mortgage Loans in Kentucky and commented:

cashout refinance va, Denied VA Loan, Fort Knox VA loans, Guide to Kentucky VA Loans, Kentucky VA Farm Loan Guidelines, Kentucky VA Homes for Sale, Kentucky VA Mortgage Calculator, kentucky va mortgage refinance guidelines, seller concessions, VA Funding Fee, VA Guidelines, VA Mortgage Rates, VA mortgage refinancing, va refinance and tagged Kentucky, Mortgage loan, Refinancing, va home loan, VA loan, VA Mortgage, Veteran