Kentucky VA Loan

VA loans are for veterans and active duty military personnel. The loan requires no down payment and no monthly mi premiums, saving you on the monthly payment. It does have an funding fee like USDA, but it is higher starting at 2.3% for first time use, and 3.6% for second time use. The funding fee is financed into the loan, so it is not something you have to pay upfront out of pocket.VA loans can be made anywhere, unlike the USDA restrictions, and there is no income household limit.

Most VA lenders I work with will want a 620 credit score even though on paper, VA says they don’t have a minimum credit score.

VA requires 2 years removed from bankruptcy or foreclosure.

VA Loan Limits for 2021 in Kentucky.

As announced previously by VA in Circular 26-19-30 (which provides interim guidance on implementing “The Blue Water Navy Vietnam Veterans Act of 2019”) the conforming loan limit cap on guarantees was removed for Veterans with full entitlement. For Veterans who have previously used entitlement and the entitlement has not been restored, the maximum amount of guaranty entitlement available to the Veteran (for a loan above $144,000) is 25 percent of the conforming loan limit reduced by the amount of entitlement previously used (not restored) by the Veteran. The new guaranty requirements apply for loans closed on or after January 1, 2020.

As a reminder, Veterans are able to use their VA Home Loan Guaranty benefit regardless of loan amount, but in order to purchase homes with loan amounts above the conforming loan limits, Veterans with partial entitlement may be required to make a down payment on amounts in excess of the conforming loan limit. Regardless of full or partial entitlement, the VA guaranty plus any required down payment must total 25% of the loan amount.

Louisville Kentucky Mortgage Loans

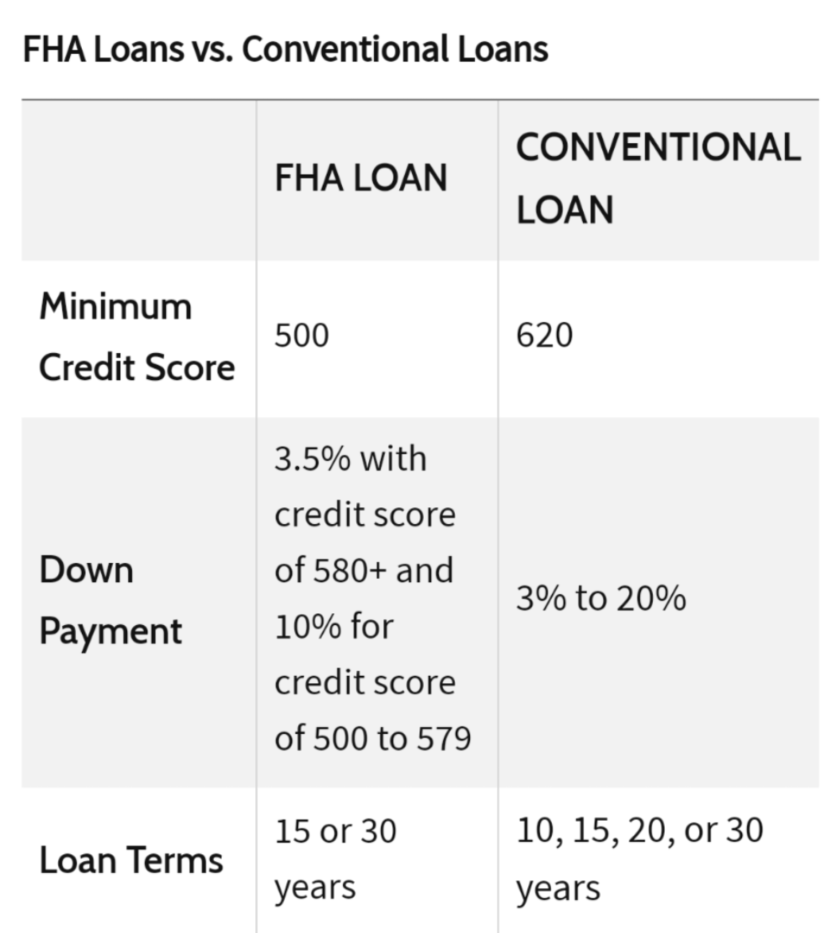

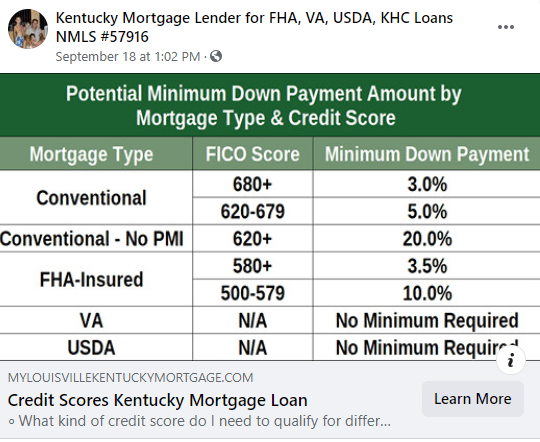

What is the minimum credit score I need to qualify for a Kentucky FHA, VA, USDA and KHC Conventional mortgage loan

What is the minimum credit score I need to qualify for a Kentucky FHA, VA, USDA and KHC Conventional mortgage loan

Mortgage Application Checklist of Documents Needed below 👇

W-2 forms (previous 2 years)

Paycheck stubs (last 30 days – most current)

Employer name and address (2 year history including any gaps)

Bank accounts statement (recent 2 months – all pages

Statements for 401(k)s, stocks and other investments (most recent)

federal tax returns (previous 2 years)

Residency history (2 year history)

Photo identification for applicant and co-applicant (valid Driver’s License

Joel Lobb (NMLS#57916)

Senior Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

Text/call 502-905-3708

kentuckyloan@gmail.com

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site…

View original post 213 more words

You must be logged in to post a comment.