A Loans in Louisville Kentucky | Ky Va home loans info

Louisville Kentucky Mortgage Loans

A Loans in Louisville Kentucky | Ky Va home loans info

I have successfully originated over 200 VA Home loans in Kentucky. Put my experience to work for you. Call or text me today at 502-905-3708 or email me at Kentuckyloan@gmail.com-This website is not affiliated with the VA or any other government agency. NMLS #57916 Equal Housing Lender. Same Day Approvals, Fast Closings, and a Local Veteran offering VA Home Loans in Kentucky. Free Credit Report and Pre-Approvals NMLS# 57916 Joel Lobb Loan Originator, Company NMLS ID 1738461 . Equal Housing Lender

A Loans in Louisville Kentucky | Ky Va home loans info

Louisville Kentucky Mortgage Loans

A Loans in Louisville Kentucky | Ky Va home loans info

bankruptcy and mortgage loan approval

How Soon Can You Qualify for a VA Loan after a Chapter 7 or Chapter 13 Bankruptcy in Kentucky?

As a reminder, these are the basic differences between bankruptcies which impact VA qualifying differently:

So, does the type of bankruptcy filed affect VA loan qualifying? The answer is YES, it most definitely does.

Please note that additional factors can contribute towards granting an exception to the 2 year policy, but any and all factors considered would have to be reviewed on a case by case scenario prior to approval. Borrowers discharged for less than a year will not generally be accepted as a satisfactory credit risk.

A. For Chapter 13 Bankruptcies that are still in progress:

B. Once the borrower has satisfactorily completed the repayment, the borrower is considered to have re-established credit

As you can see, the type of bankruptcy can drastically impact VA loan eligibility and the required waiting period.

If you have filed for chapter 7 or chapter 13 bankruptcy, then you can still qualify for a mortgage just one day out of bankruptcy. Today, there are thousands of people who are trying to find a mortgage after filing for bankruptcy. In the past, finding a mortgage after a bankruptcy was not the easiest thing to do. The good news is that today you can get a mortgage just one day out of bankruptcy.

There are bankruptcy lenders who can help with your mortgage even just one day out of chapter 7 or chapter 13 bankruptcy. You will likely need a larger down payment and show that you are taking steps to improve your credit.

Below, we will take you through some mortgage after bankruptcy options and then connect you with some of the best bankruptcy lenders. We understand that you area dealing with a lot and having a bankruptcy is not easy. Let us help guide you through this process.

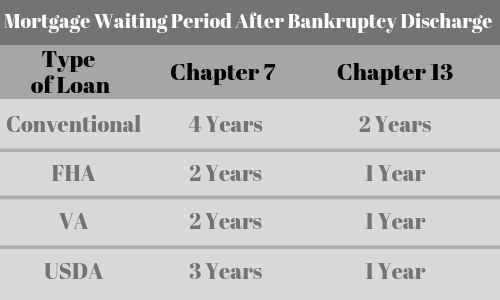

| Type of Loan | Chapter 7 | Chapter 13 |

| Conventional | 4 years | 2 years |

| FHA | 2 years | 1 year |

| VA | 2 years | 1 year |

| USDA | 3 years | 1 year |

| Subprime | 1 day | 1 day |

Every type of loan has different waiting period requirements. Here are some of the basics:

y.

Down payment assistance

down payment grant

You must be logged in to post a comment.