Calculating Residual Income:

How to Calculate Residual Income for a Kentucky VA Home Loan Approval (2026)

Kentucky veterans using a VA home loan must meet minimum residual-income requirements. Residual income measures the monthly funds left over after housing costs, taxes, and all recurring bills. It is a core underwriting factor that determines whether a VA loan can be approved, especially when debt-to-income ratios are higher or credit depth is limited.

This guide breaks down how residual income works, how to calculate it correctly, and the 2026 minimums required for Kentucky VA buyers.

Helpful links for Kentucky buyers:

What Is Residual Income?

Residual income is the amount of money left after subtracting all monthly obligations from the borrower’s gross monthly income. The VA establishes region-based minimums to ensure borrowers have enough remaining funds to cover essentials such as food, transportation, clothing, utilities, and other living expenses.

Even if a borrower has a high credit score and a strong DTI ratio, the loan cannot be approved without meeting minimum residual-income thresholds.

How Kentucky Lenders Calculate VA Residual Income

- Start with gross monthly income for all occupying borrowers.

- Subtract federal, state, and local taxes based on paystubs/W-2 withholding tables.

- Subtract the proposed housing payment (PITI): principal, interest, taxes, insurance, HOA, and any maintenance fees.

- Subtract all recurring debts:

- auto loans

- student loans

- credit card minimums

- child support / alimony

- personal loans or installment debt

- Subtract estimated utilities/maintenance. Many lenders use approximately $0.14 per square foot of heated living space.

The figure remaining after all these deductions is the official VA residual income.

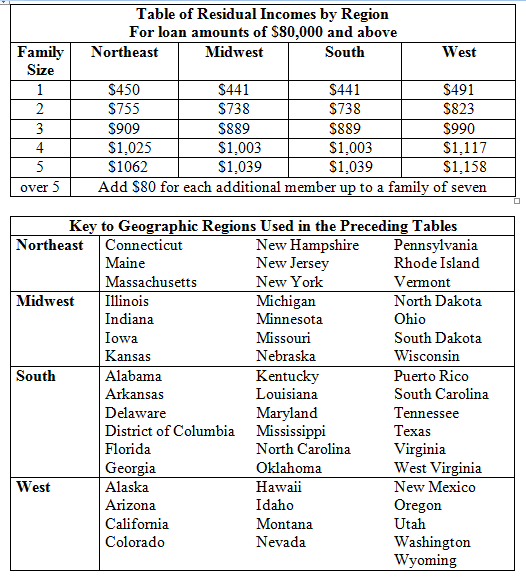

2026 VA Residual Income Requirements for Kentucky (South/Midwest Region)

| Household Size | Minimum Residual Income |

|---|---|

| 1 Person | $441 |

| 2 Persons | $738 |

| 3 Persons | $889 |

| 4 Persons | $1,003 |

| 5 Persons | $1,039 |

| Each Additional Person | Add $80 |

If debt-to-income ratio exceeds 41 percent, underwriters typically require 20 percent more than the baseline residual number.

Why Residual Income Matters More Than DTI

Residual income is one of the strongest predictors of loan performance in the VA program. Borrowers who meet or exceed the residual-income benchmark show significantly higher repayment success rates — even when credit scores are less than perfect or DTI ratios appear high.

If the loan does not meet residual income, the file cannot be approved without compensating factors or structural changes to qualifying income or household composition.

Free Help Calculating Residual Income

If you want, I can run a complete residual-income analysis for you or your buyer using up-to-date 2026 VA guidelines.

EVO Mortgage (Company NMLS 1738461)

10602 Timberwood Cir, Suite 3, Louisville KY 40223

Reblogged this on Kentucky First-Time Homebuyer Loan Programs for FHA, VA, KHC and USDA Mortgage Loans in Kentucky and commented:

Residual Income for a Kentucky VA Home