VA Loans in Kentucky: A Veteran’s Path to Homeownership

If you’re a veteran, active-duty service member, or eligible surviving spouse looking to buy a home in Kentucky, the VA loan program is one of the most powerful mortgage options available. Backed by the U.S. Department of Veterans Affairs, VA loans allow zero down payment, no monthly mortgage insurance, and competitive interest rates.

Who Is Eligible for a VA Mortgage Loan in Kentucky?

To qualify, you need a valid Certificate of Eligibility (COE). You may be eligible if:

- You served 90 consecutive days during wartime,

- 181 days during peacetime,

- Or 6 years in the Reserves or National Guard

- Surviving spouses of service members may also qualify.

Need help getting your COE? Click here to contact Joel Lobb.

Credit Score Requirements for Kentucky VA Loans

The VA does not have a minimum credit score requirement, but most Kentucky lenders typically look for a FICO score of 580–620+. That said, manual underwriting is available for scores as low as 500 with strong compensating factors.

Have bad credit, collections, or charge-offs? VA loans are more forgiving:

- Medical collections are often excluded.

- Charge-offs do not always need to be paid.

- Student loans are handled differently than FHA or conventional.

👉 Learn more: Kentucky VA Loan for Bad Credit

Work History and Income Guidelines

Most lenders prefer a 2-year stable work history, but gaps or job changes are acceptable with a written explanation.

Residual Income Requirement:

VA loans use residual income instead of front-end housing ratios. You must have enough income left over after all monthly obligations to cover living expenses.

Debt-to-Income Ratio (DTI):

- Max DTI: 41% (can go higher with strong residual income or DU/LP approval)

- No cap if Desktop Underwriter (DU) or Loan Prospector (LP) gives an “Approve/Eligible” status

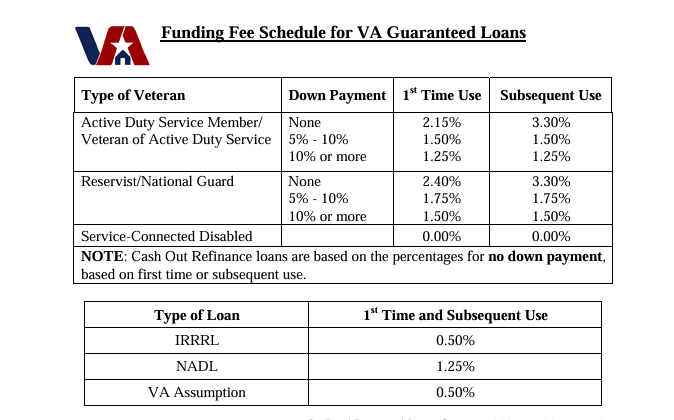

Down Payment, Rates & Funding Fee

- Down Payment: $0 required

- VA Funding Fee: Financed into the loan (waived for disabled vets)

- Interest Rates: Competitive, typically lower than FHA or Conventional

- Loan Terms: 15, 20, 25, and 30 years available

Appraisal & Termite Requirements in Kentucky

- Homes must meet VA Minimum Property Requirements (MPRs)

- Termite inspections are required in Kentucky and must be cleared before closing

- Appraisal can impact value, but repairs can often be negotiated with the seller

Collections, Charge-Offs, and Student Loans

- Collections: No need to pay unless judgment has been issued

- Charge-Offs: Usually ignored unless recent or large

- Student Loans: Counted at 5% of the balance if deferred or in forbearance

Bankruptcy, Foreclosure & Manual Underwriting

You can still qualify for a VA loan in Kentucky after:

- Chapter 7 bankruptcy: 2 years after discharge

- Chapter 13 bankruptcy: 12 months of on-time payments with trustee approval

- Foreclosure or short sale: 2 years from the event

If you don’t qualify through DU or LP, manual underwriting is an option. This requires stronger documentation, compensating factors like low DTI or extra assets, and no major credit issues in the last 12 months.

Closing Costs & Seller Concessions

- Seller can pay up to 4% of the purchase price in concessions, including:

- Prepaids

- Escrow setup

- Discount points

- VA Funding Fee

- You can roll in closing costs or have them paid by the seller or lender

How to Apply for a VA Loan in Kentucky

- Submit financial documents: pay stubs, W-2s, tax returns, bank statements

- Get COE and credit report pulled

- Start home shopping with a Realtor familiar with VA guidelines

- Lock in your interest rate and complete the underwriting process

- Close and move into your new home!

Why Work with Joel Lobb?

With over 20 years of mortgage experience and a Army Veteran and more than 1,300 families helped, Joel Lobb is a trusted mortgage advisor for Kentucky veterans. His team provides:

Free same-day pre-approvals

Personalized service — no call centers

Expertise with manual underwriting

Help with credit improvement

Access to VA, FHA, USDA, and KHC down payment assistance programs

Call/Text: (502) 905-3708

Email: kentuckyloan@gmail.com

Website: MyLouisvilleKentuckyMortgage.com

Additional Resources (Internal Links)

- Kentucky VA Loan Manual Underwriting Guidelines

- How to Buy a Home in Kentucky with No Money Down

- Kentucky FHA vs. VA Loan Comparison

- Complete VA Home Loan Guide for Kentucky Homebuyers

👉 Ready to get started? Apply Now for a Kentucky VA Loan

Joel Lobb Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS 57916 |

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

You must be logged in to post a comment.