Kentucky VA Appraisal and Tidewater Guide

The VA appraisal is a required checkpoint for Kentucky homebuyers using a VA mortgage. It serves two purposes: confirming fair market value and verifying that the property meets the Minimum Property Requirements established by the [“organization”,”U.S. Department of Veterans Affairs”,”federal veterans agency”]. When expectations are misaligned, delays and renegotiations can follow. This guide explains how the process works, where issues typically arise in Kentucky, and how Tidewater fits into the equation.

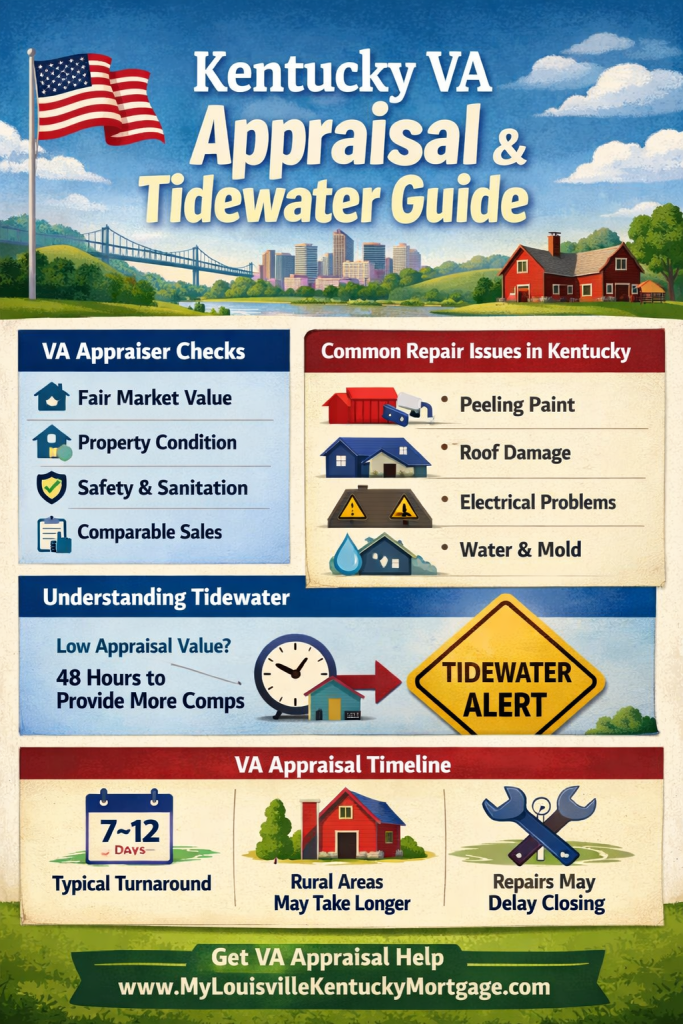

What a VA Appraiser Evaluates

A VA appraisal is not a home inspection, but it is more comprehensive than a standard value-only appraisal. The appraiser is acting on behalf of the VA, not the buyer, seller, or lender.

- Market value based on recent closed comparable sales

- Overall property condition under VA Minimum Property Requirements

- Safety, structural integrity, and basic sanitation

- General marketability of the home in the local Kentucky market

If a visible issue affects safety or livability, the appraiser is required to address it.

Common Kentucky VA Repair Triggers

Many Kentucky homes are older, which increases the likelihood of condition-related findings. The most common VA repair items include:

- Peeling or chipping paint on homes built before 1978

- Roof wear, missing shingles, or signs of active leaks

- Missing handrails on stairways with three or more steps

- Electrical hazards, outdated panels, or exposed wiring

- Water intrusion, moisture damage, or suspected mold conditions

When repairs are required, they must be completed and reinspected before the loan can close.

How the VA Tidewater Process Works

Tidewater is a built-in safeguard designed to prevent veterans from overpaying for a property.

If the appraiser believes the value may be lower than the contract price, Tidewater must be initiated before the appraisal is finalized. Once triggered:

- The lender notifies the buyer’s real estate agent

- The agent has 48 hours to submit additional comparable sales

- The appraiser reviews the new data before issuing a final value

Tidewater does not guarantee a higher value, but it ensures all relevant market data is reviewed before a low appraisal is issued.

VA Appraisal Timelines in Kentucky

- Typical turnaround is 7 to 12 days

- Rural counties may take longer due to appraiser availability

- Required repairs and reinspections can extend the closing timeline

Proper planning and realistic expectations are critical, especially in tight contract periods.

Practical Guidance for Kentucky VA Buyers

The appraisal phase is where preparation pays off. Strong transactions are positioned before the appraisal is even ordered.

- Evaluate property condition early, not after the appraisal

- Confirm comparable sales support the contract price

- Be prepared for Tidewater without reacting emotionally

- Work with a lender experienced in Kentucky VA lending

When handled correctly, the VA appraisal protects the buyer and strengthens the transaction.

Need Help With a VA Appraisal or Tidewater Issue?

If you are dealing with a VA appraisal concern, Tidewater notice, or required repairs in Kentucky, early intervention reduces risk and keeps the deal moving.

Get VA appraisal guidance from a Kentucky VA mortgage expert

Clear expectations, disciplined execution, and informed decision-making are what close VA loans on time.

| Joel LobbMortgage Broker – FHA, VA, USDA, KHC, Fannie MaeEVO Mortgage • Helping Kentucky Homebuyers Since 2001 |

Call/Text: 502-905-3708 Call/Text: 502-905-3708 Email: kentuckyloan@gmail.com Email: kentuckyloan@gmail.com Website: www.mylouisvillekentuckymortgage.com Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave, Louisville, KY 40204 Address: 911 Barret Ave, Louisville, KY 40204NMLS #57916 | Company NMLS #1738461 |

| Free Info & Homebuyer Advice → |

| Kentucky Mortgage Loan ExpertFHA | VA | USDA | KHC Down Payment Assistance | Fannie MaeEqual Housing Lender. This is not a commitment to lend. All loans are subject to credit approval and program requirements. |

You must be logged in to post a comment.