There are basically three things we look at: Credit, Income, Assets.

Credit:

You must have a minimum credit score of 640

Typically they want you to have a 2 year work history, does not have to be on same job, and the house payment should not be more than 1/3 of your gross income. For example, if you make 2k gross a month, then your max house payment should be around $700-800 range.

As far assets, you typically don’t need a down payment, but it is always good to show at least 2 months reserves in the bank.

You will have to pay for an appraisal fee of $325, and home inspection of $400-350 typically, but this is usually the only out of pocket costs.

The seller can pay your closing costs, and it takes about 30 days to close a loan when you get a accepted offer.

If you don’t mind, go ahead and get the following things together and I will see what you how much qualify for on a home.

This is a free process, in case you were wondering.

The following is a list of documents that may be required to process your mortgage loan:

One full month’s worth of pay stubs

Last 2 years W-2’s

Last 2 years tax returns with all schedules

Last two months bank statements for all accounts

Documentation to support your funds to close

Explanation for any derogatory credit (if applicable)

Bankruptcy and discharge paperwork (if applicable)

Divorce decree and settlement paperwork (if applicable)Read more: http://www.mylouisvillekentuckymortgage.com/

Kentucky First-Time Home Buyer Programs | USDA, FHA, VA & KHC Loans

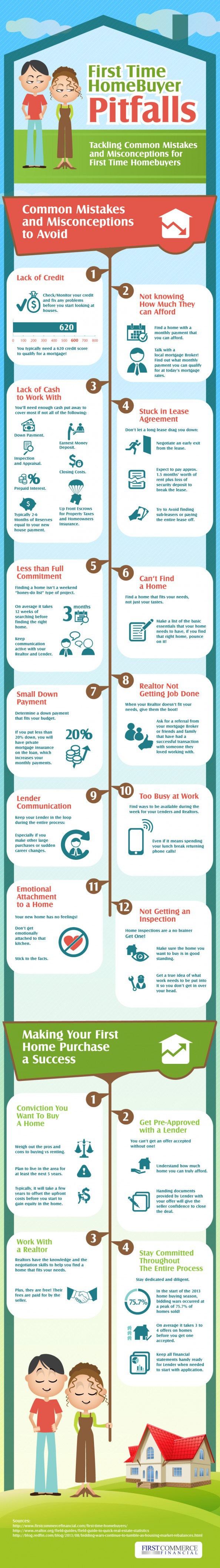

Kentucky First Time Homebuyer First Time Homebuyer Pitfalls to Avoid.

via First Time Homebuyer Pitfalls to Avoid.

—

Senior Loan Officer

phone: (502) 905-3708

CONFIDENTIALITY NOTICE: